HMRC have brought out new legislation which comes into effect at the start of the new UK tax year on the 6th April 2017. It will affect radiographers working as agency on the NHS who are paid through a limited company.

This means that the previous tax relief benefits of operating under a limited company are going to be a thing of the past and tax and national insurance will now have to paid under the PAYE effect, as though you were employed. This effectively will take 50% of your limited company earnings and you won’t receive any of the benefits of employed staff. It should also be highlighted that you will still take home considerably more than employed staff.

The current UK government have declared, in the budget, that we are moving towards a ‘more tax, less spend model’ and have their eyes on the third largest employer in the world, the NHS. So what does this mean to limited company Locums? Your agency is now responsible for you paying the correct tax and national insurance, if you are now deemed to be within IR35.

What is IR35?

IR35 is tax legislation, largely ignored by the government, until now which can enable an individual without a limited company to operate as a contractor and have their tax calculated either through their agency or pay an umbrella company to do this for them. Most agency staff take out the third party and form a limited company which means they have tax deducted from them under company tax legislation which is generally capped at 20% and pay themselves a salary which falls under the taxable allowance. By forming a limited company, they can afford to save part of their gross income for sick and holiday pay. If you are paid by the agency as PAYE or through an umbrella company, you have very little rainy day money and are probably better off being employed if you are the main income provider.

What to do now?

The government have now set up a tool on the government website which enables you to check if your contract falls within the IR35 legislation. This does give various different outcomes and has been reported to classify the similar contracts as both in and outside of IR35 and is a pretty useless tool (I wonder if IT contractors were asked to make this?). Most NHS trusts have put a complete blanket IR35 stamp on all contractors leaving no room for manoeuvre.

Other non-clinical fields, working in the public sector, have demanded a 15-20% increase in their contract rate, says Neil Lupin of Green Park recruitment agency. This is something that all agency radiographers in a contract with the NHS should be doing in order to obtain holiday and sick pay.

How you want to be paid

From the 6th of April if you are a Locum radiographer working for the NHS through a limited company and are within the IR35 or have been told you are, by the trust you’re currently working for, you will have to seek a different method of payment. Your responsibility for self-assessment is no longer.

This isn’t entirely true you can still operate a limited company and be paid a net salary, after tax and national insurance into your business account and still complete a self-assessment. This way if you do any private work you can be paid gross.

You can choose an umbrella company and pay them a weekly fee for deducting tax and national insurance. It is illegal for your agency to stop you from using any IR35 compliant umbrella company. Agencies may have their preferred list but you can choose your own.

Your agency can pay you under their own PAYE scheme.

What benefits can I claim

In 2016 new legislation was brought in affecting what you can claim working under an intermediary. An employment intermediary is (ESM5510 www.gov.uk)

- An agency

- A recruitment or employment business

- An umbrella company

- An MSC

- A PSC

You can no longer claim for ‘ordinary commuting’ so you are expected to pay for

- Travel in the performance of your duties

- Travel to or from a place the necessarily attend in the performance of their duties (excluding ordinary community)

- Travel between a worker’s home and a temporary’ workplace

You can no longer claim for meals or food consumed as part of your working day even if you have a receipt.

You can claim for the cost of protective clothing or clothing required for the performance of your role.

You are able to claim for subscriptions to professional bodies or societies.

The big Tax Break

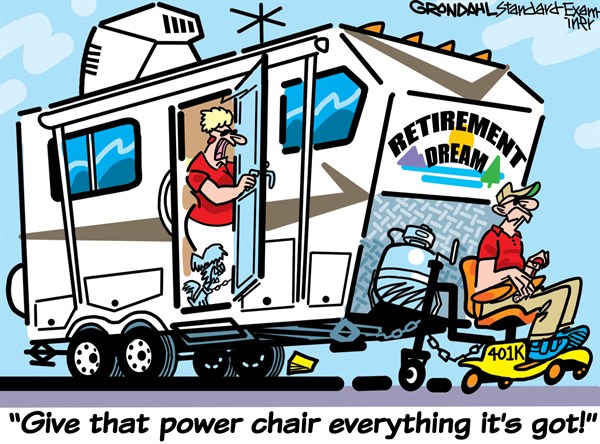

Umbrella companies do give people an opportunity to gain massive savings through pension contributions which would enable you possible to take early retirement. After ploughing through the mine fields of umbrella companies, you will probably want to take opportunity of the pension tax break!

I called 5 umbrella companies each of them without fail and before quoting asked me which agency I was with and who was my contact at this agency. When I questioned them why that was relevant most of them backtracked and said it wasn’t it’s just information they took as part of their sales quotation. I know what your all thinking! One umbrella company advised me it was because the agency contribute to the fee and that if I was with RIG I would get a bigger reduction in my fee than my current agency!

So this is what I found when I made a few enquiries, I chose a random rate as an example: –

Umbrella

Company |

Rate |

Hours worked |

Assumed

Expenses |

Quotation for take home pay |

Fee |

Pension contribution |

Take home -pension |

| My pay |

£32p/h |

37.5 |

5% |

820 |

£14p/week |

£100 p/wk |

£810 |

| CPS |

£32p/h |

37.5 |

0% |

761.50 |

£10p/week |

Do not offer |

|

| Brookson |

£32p/h |

37.5 |

0% |

753 |

£25p/week |

£100 p/wk |

£702 |

| Ricson Services |

£32p/h |

37.5 |

0% |

757 |

£24p/week |

£100 p/wk |

|

| Liquid Friday |

£32p/h |

37.5 |

0% |

748.20 |

£24p/week |

After 12 weeks @1% |

|

Correct as of March 2017

The Break Down

Working still with £32 an hour you will pay roughly –

Gross pay £1200

Tax £218

Employees NI contribution £85

Employers NI contribution £125

Umbrella company fee £24

Total £452

Net pay £748

You can reduce all three of these elements by significantly adding to your pension through an umbrella company. You can contribute up to 48% of your salary, although by ringing around a pension was never offered to me and caused a slight headache when I asked about one. Some umbrella companies would only allow you to use their own affiliated company otherwise I was told I would have to seek a tax rebate at the end of the tax year which slightly defeats the purpose and the main perk of an umbrella company. Some of the advisers also seemed to think that a 1% contribution was set in stone which I found frustrating. I was told by one umbrella company that £24 a week fee was the maximum fee but, as you can see, one company charged me £25. They all told me that the fee was not negotiable but from working previously as an agency radiographer some years ago, under an umbrella company, I regularly would negotiate the fee.

Whilst trawling through the hundreds of You Tube posts on the NHS I found a short video on the NHS’s need for agency staff from 2015. Alice Turner, the Principle Radiographer at the University North Staffordshire hospital, speaks out about radiology not keeping pace with demand and the important role agency staff play in rectifying this. With new Radiologists hard to recruit and the length of time it takes to train employed radiographers to film read a quick solution was to organise agency radiographer film readers. This helped share knowledge and experience amongst a group with a common goal and help this hospital ‘keep pace’ whilst radiologists focused on CT and MRI scan reports. If the agency staff now stop due to the agency pay cuts how will the NHS keep pace?

Whilst trawling through the hundreds of You Tube posts on the NHS I found a short video on the NHS’s need for agency staff from 2015. Alice Turner, the Principle Radiographer at the University North Staffordshire hospital, speaks out about radiology not keeping pace with demand and the important role agency staff play in rectifying this. With new Radiologists hard to recruit and the length of time it takes to train employed radiographers to film read a quick solution was to organise agency radiographer film readers. This helped share knowledge and experience amongst a group with a common goal and help this hospital ‘keep pace’ whilst radiologists focused on CT and MRI scan reports. If the agency staff now stop due to the agency pay cuts how will the NHS keep pace? So if you want to reduce your tax contributions, working within IR35, you can by saving to a pension. The Government will contribute up to 49% of your pension which can give a very healthy return.

So if you want to reduce your tax contributions, working within IR35, you can by saving to a pension. The Government will contribute up to 49% of your pension which can give a very healthy return.